ACC supports and advocates for policies which drive economic growth, common sense and science-based public policy which encourages innovation, creates jobs, and enhances public and environmental health and safety.

Chemistry Action Network

Join the Movement

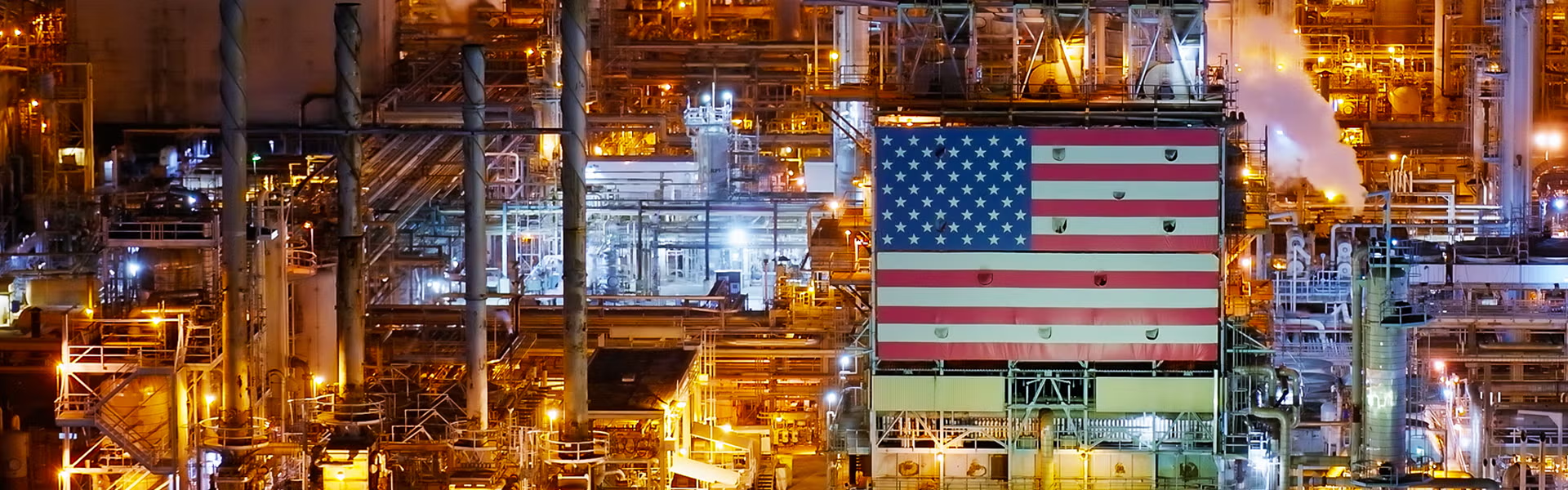

The Chemistry Action Network is a coalition of industry leaders and advocates united by a single goal: to champion the policies and investments that ensure chemistry continues to drive American progress, from energy and infrastructure to national defense and new technology.

Now more than ever, the U.S. needs a coordinated voice highlighting chemistry's strategic impact. The Chemistry Action Network will engage lawmakers, policymakers, and the public to promote innovative, forward-looking policies that strengthen domestic production, create jobs, and secure long-term growth. Your partnership will help ensure that chemistry remains a pillar of American competitiveness.

Together, we can elevate the voice of chemistry, protect what we’ve built, and shape a stronger future for American innovation and industry.

Sign up today!

Chemistry's Impact

Quicklinks

Business of Chemistry by the Numbers