Note: CPI, Real Wages, the Producer Price Index, Retail Sales, and Business Inventories were scheduled for release this week but are unavailable due to the federal government shutdown. Where available, we will include alternative private-sector data in order to continue monitoring the U.S. economy.

Global manufacturing expanded slightly in October with the JP Morgan Global Manufacturing PMI edging higher by 0.1 point to 50.8. Output and orders were higher across consumer, intermediate and investment goods categories. Among the countries where manufacturing expanded at the fastest pace were India, Thailand, and Vietnam. Eurozone manufacturing was neutral, neither expanding nor contracting. Several large economies continued to see contractions in manufacturing, including Japan, Brazil, Taiwan, South Korea, Turkey, Canada and Mexico.

Borrowing rose in September as consumer debt climbed at a 3.1% annual rate, up from a revised gain of 0.7% in August. Credit card balances increased 1.5% after plunging 5.6% in August, while balances on nonrevolving debt, such as student loans and car loans, leaped 3.7%, on top of a 2.9% rise in August.

Small business optimism waned in October as the headline index eased 0.6 points to 98.2. Lower earnings and higher materials costs drove the decline in the overall index. The level of uncertainty fell, however. Labor quality was reported to be the top business problem and nearly one-third of business owners reported job openings they couldn’t fill.

The headline Visa Spending Momentum Index (SMI) rose 0.3% to 98.6 in October, up for the second month in a row. While still below 100, the October reading is the highest since July (values above 100 signal strengthening momentum in consumer spending, while values below 100 suggest weakening). SMI is an economic indicator measuring consumer spending based on purchasing data from Visa-branded credit and debit cards.

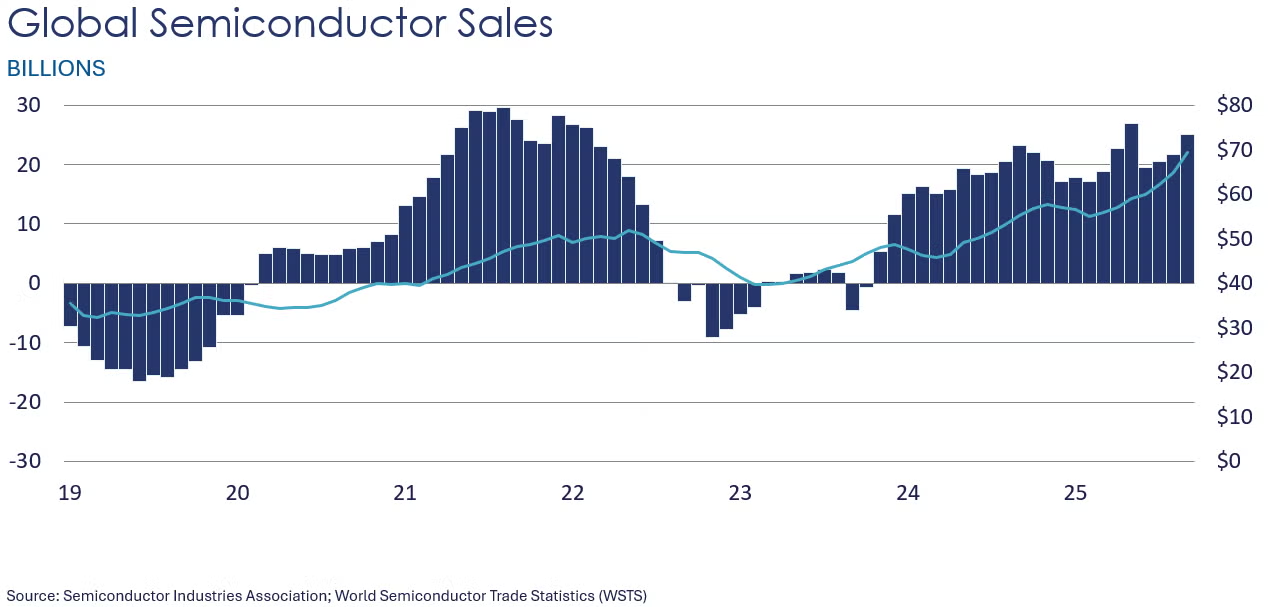

Global semiconductor sales rose 7.0% to $69.5 billion in September, a new record high. Sales in September rose in every region with the largest gains in the Americas and Asia (excluding Japan and China). Chip sales were up 25.1% Y/Y.

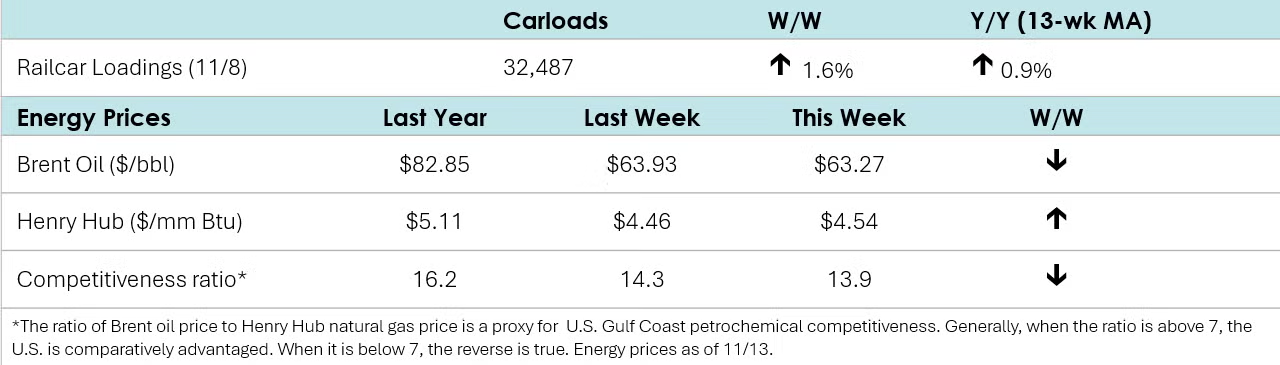

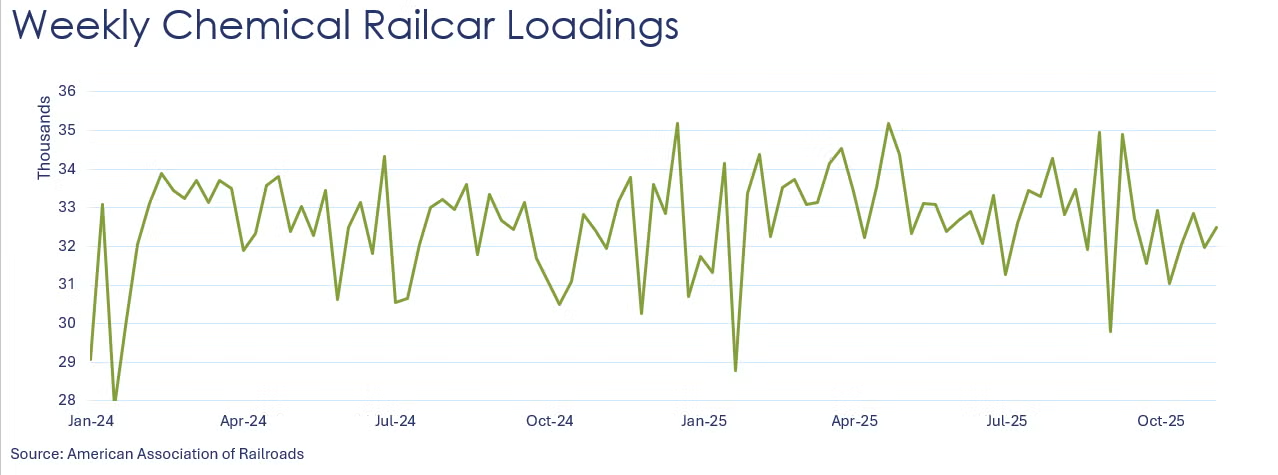

According to data released by the Association of American Railroads, chemical railcar loadings rose to 32,487 for the week ending November 8th. Loadings were up 0.9% Y/Y (13-week MA), up 1.6% YTD/YTD and have been on the rise for ten of the last 13 weeks.

Energy Wrap-Up

• Oil futures eased from a week ago, largely due to new projections from OPEC that oil supply will match demand in 2026. In previous reports, OPEC projected a supply deficit.

• U.S. natural gas prices continued to climb on colder weather.

• The combined oil & gas rig count rose by three to 542 during the most recent week.

For More Information

ACC members can access additional data, economic analyses, presentations, outlooks, and weekly economic updates through ACCexchange: https://accexchange.sharepoint.com/Economics/SitePages/Home.aspx

In addition to this weekly report, ACC offers numerous other economic data that cover worldwide production, trade, shipments, inventories, price indices, energy, employment, investment, R&D, EH&S, financial performance measures, macroeconomic data, plus much more. To order, visit http://store.americanchemistry.com/.

Every effort has been made in the preparation of this weekly report to provide the best available information and analysis. However, neither the American Chemistry Council, nor any of its employees, agents or other assigns makes any warranty, expressed or implied, or assumes any liability or responsibility for any use, or the results of such use, of any information or data disclosed in this material.

Contact us at ACC_EconomicsDepartment@americanchemistry.com.