MACROECONOMY & END-USE MARKETS

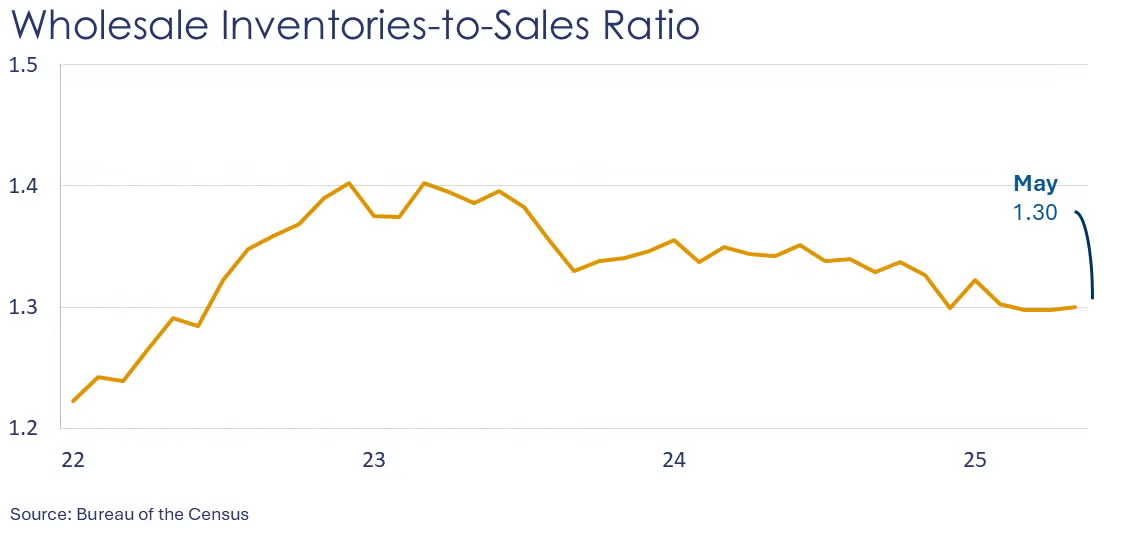

Wholesale inventories declined 0.3% in May, following a 0.1% increase in April. The largest drops in inventories were in farm products, professional/computer equipment, miscellaneous durable goods, furniture, and chemicals. The largest increases were in petroleum products, pharmaceuticals, alcohol products, and hardware. Sales at the wholesale level also decreased 0.3% in May after being flat in April. Compared to a year ago, wholesale sales were up 4.8% Y/Y while inventories were ahead by 1.4% Y/Y. The inventories-to-sales ratio remained steady compared to April at 1.30. A year ago, the ratio was 1.34.

Global semiconductor sales rose 3.5% in May to $59.0 billion. Sales were higher across all regions, with the largest gains in China, other Asia (excluding Japan) and Europe. Compared to a year ago, sales were up 27.0% Y/Y.

Small business optimism remained essentially steady in June, edging down 0.2%. A substantial increase in respondents reporting excess inventories contributed the most to the decline in the index. Offsetting that was a decline in the uncertainty index, which has held back optimism in recent months.

Borrowing cooled in May as growth in consumer debt eased to a 1.2% annual rate. Declining credit card balances were only slightly offset by higher balances on nonrevolving debt (e.g., student loans and car loans).

CHEMICALS

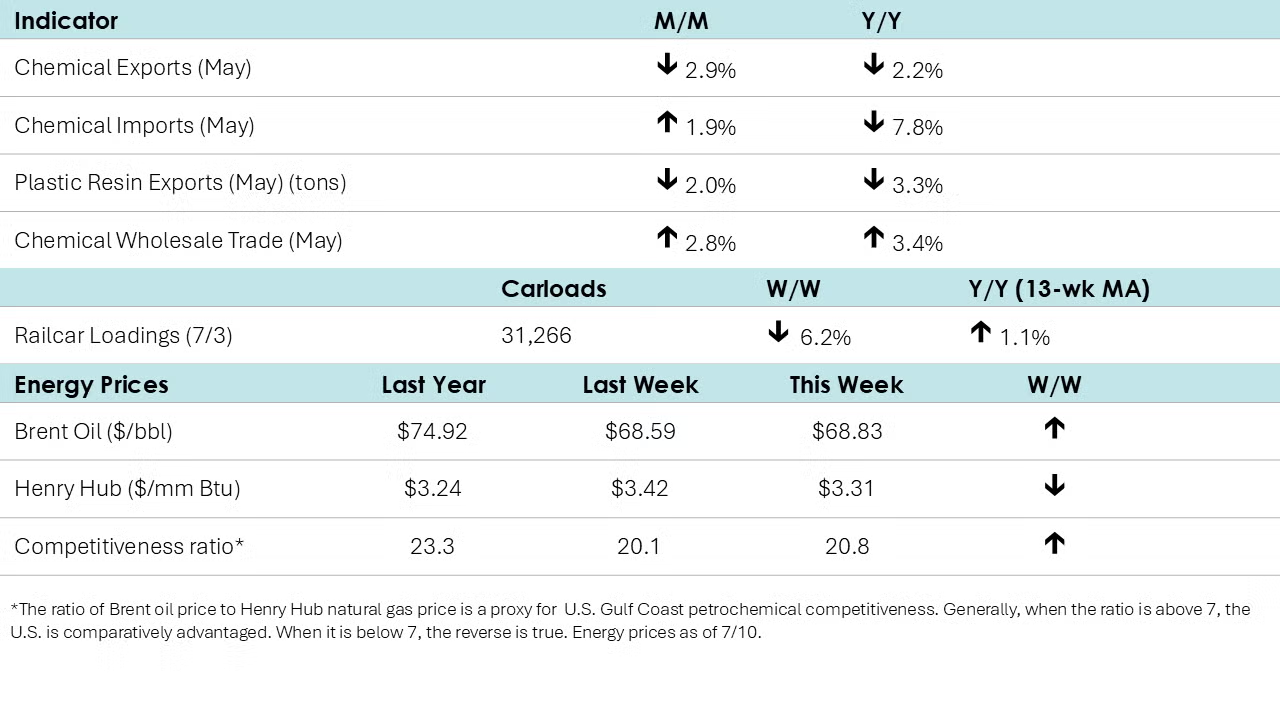

According to data released by the Association of American Railroads, chemical railcar loadings were down to 31,266 for the week ending July 5th (which included the Fourth of July holiday). Loadings were up 1.1% Y/Y (13-week MA), up 1.6% YTD/YTD and have been on the rise for six of the last 13 weeks.

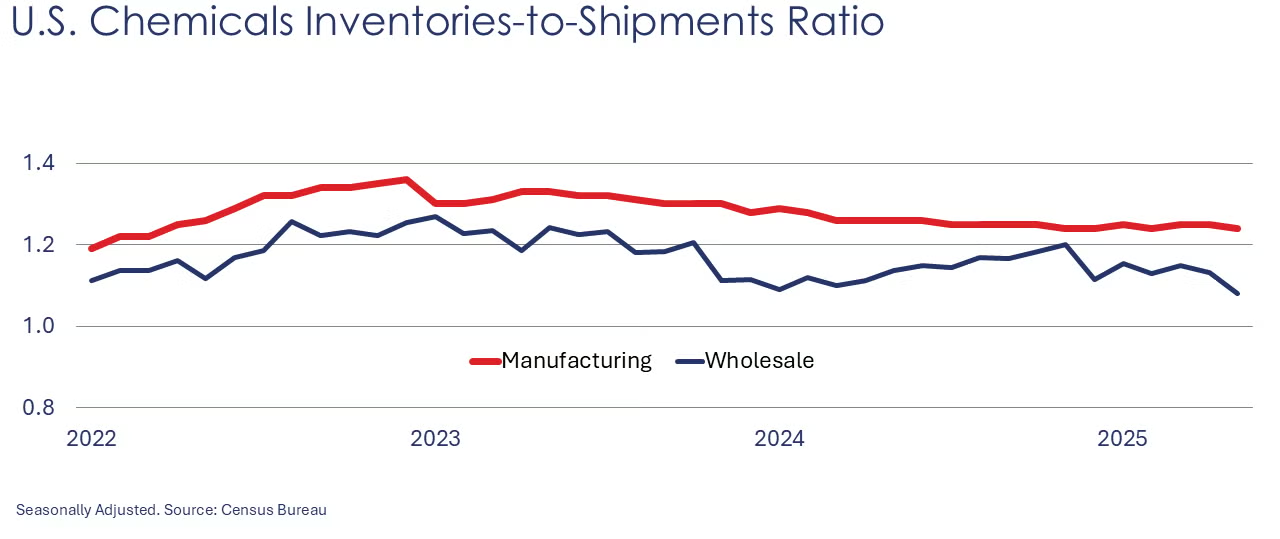

Sales of chemicals at the wholesale level rose 2.8% in May (following a 0.2% gain in April). Chemical wholesale inventories fell 1.9% (after a 1.2% drop in April). Compared to a year ago, sales were higher by 3.4% Y/Y while inventories were down 1.8% Y/Y. The inventories-to-sales ratio for chemicals fell from 1.13 in April to 1.08 in May, the lowest since May 2021. A year ago, the ratio was 1.14.

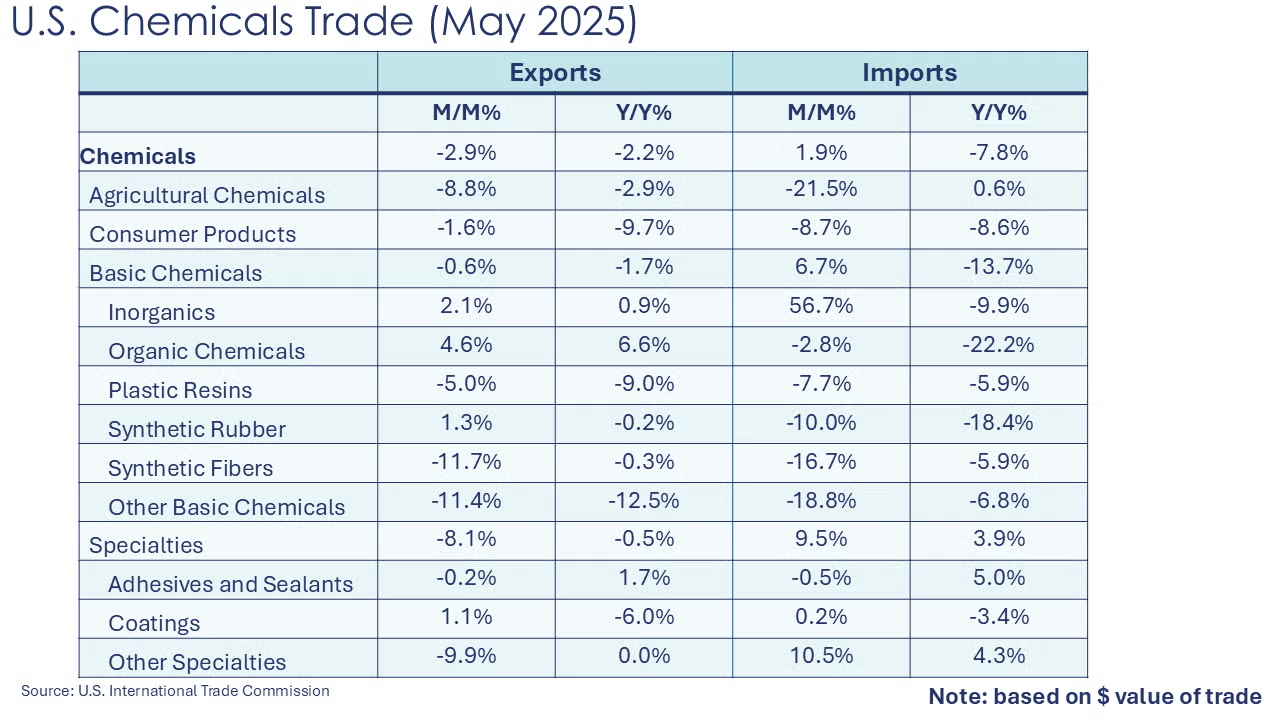

Chemical exports decreased by 2.9% in May as trade-related uncertainties weighed on export demand. All major categories saw decline, but the most significant drop was seen in agricultural (-8.8%) and specialty chemicals (-8.1%). Imports rose by 1.9%, driven mainly by a whopping 56.7% increase in inorganics, followed by other specialties, which grew by 10.5%. Compared to a year ago, both exports and imports decreased by 2.2% and 7.8%, respectively. The chemical trade surplus shrank from $2.5 billion in April to $1.9 billion in May.

After a sharp drop in April, U.S. plastic resin exports declined by another 2.0% in May to 2.0 million metric tons. Compared to a year ago, resin exports were down 3.3%.

Energy Wrap-Up

- Oil prices were slightly higher following the resumption of attacks in the Red Sea which offset the impact of an OPEC+ agreement to increase production by a larger-than-expected amount starting in August.

- Natural gas inventories continue to build and remain above their five-year historic average.

- The combined oil & gas rig count fell for a tenth consecutive month, down by eight to 533.

For More Information

ACC members can access additional data, economic analyses, presentations, outlooks, and weekly economic updates through ACCexchange.

In addition to this weekly report, ACC offers numerous other economic data that cover worldwide production, trade, shipments, inventories, price indices, energy, employment, investment, R&D, EH&S, financial performance measures, macroeconomic data, plus much more. To order, visit http://store.americanchemistry.com/.

Every effort has been made in the preparation of this weekly report to provide the best available information and analysis. However, neither the American Chemistry Council, nor any of its employees, agents or other assigns makes any warranty, expressed or implied, or assumes any liability or responsibility for any use, or the results of such use, of any information or data disclosed in this material.

Contact us at ACC_EconomicsDepartment@americanchemistry.com.