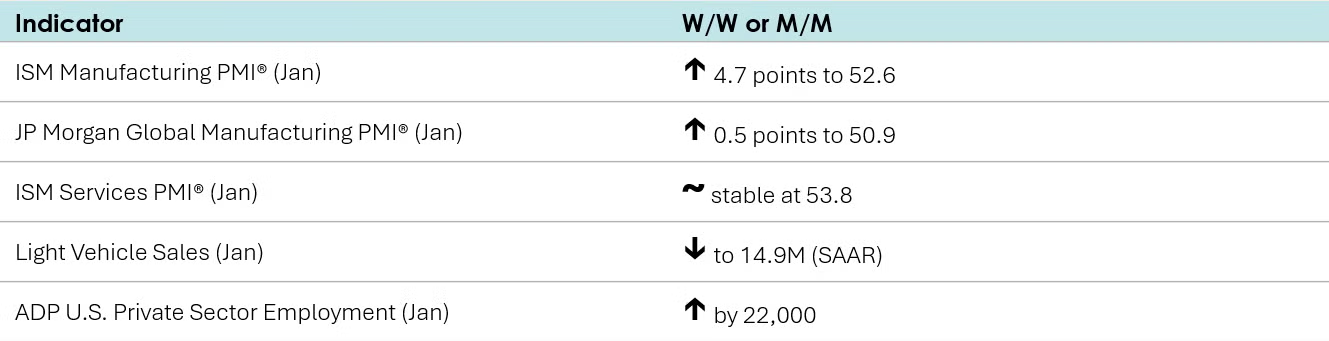

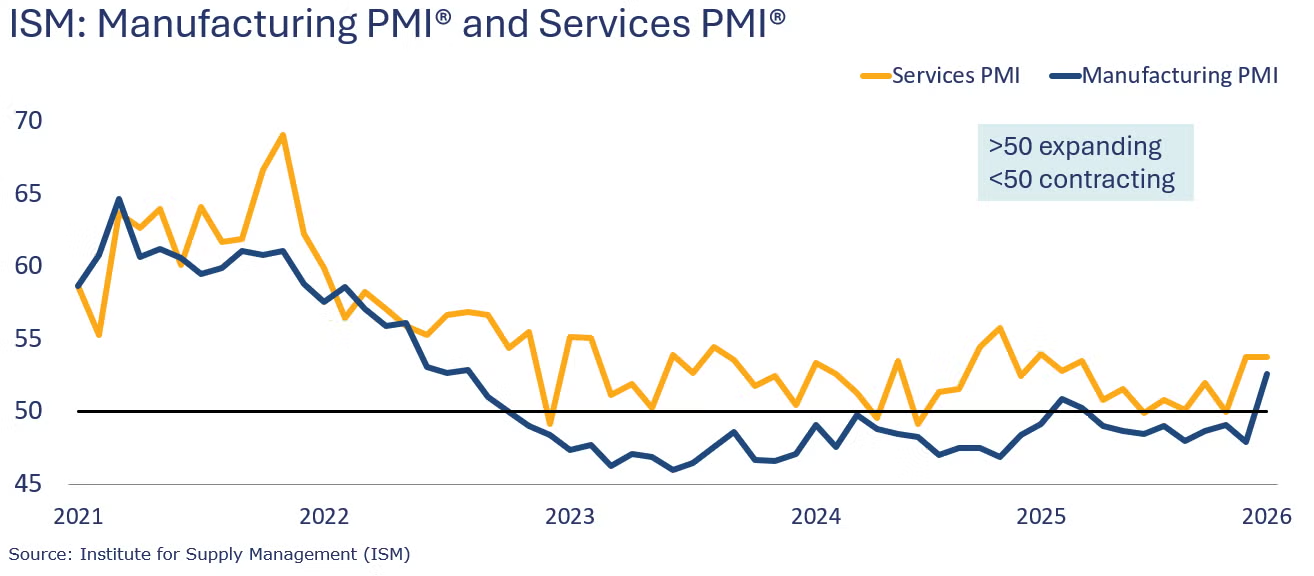

Private sector employment rose by 22,000 according to ADP’s employment report. Another strong gain in healthcare employment and gains in construction, financial services, leisure & hospitality and trade & transportation offset declines in other sectors, including manufacturing which has lost jobs in every month since March 2024. Large employers and some small businesses (between 20-49 employees) shed jobs while mid-sized businesses and very small businesses (between 0-19 employees) added headcount.

U.S. businesses announced plans for over 108,000 layoffs in January, up 118% from a year earlier and 205% from December, according to Challenger, Gray & Christmas, an executive staffing firm. January’s layoff announcement was the highest for that month since 2009. The industries with the highest announced layoffs include transportation, technology, healthcare, and chemical manufacturers, with the latter announcing 4,700 cuts in January. This was the highest monthly announcement for that industry since February 2016, and it was reportedly associated with AI implementation and automation.

Job openings declined in December, down by 386,000 to 6.5 million. Back in December 2024, job openings totaled 7.5 million. Both layoffs and quits (a measure of workers’ willingness to leave a job) were essentially unchanged from November.

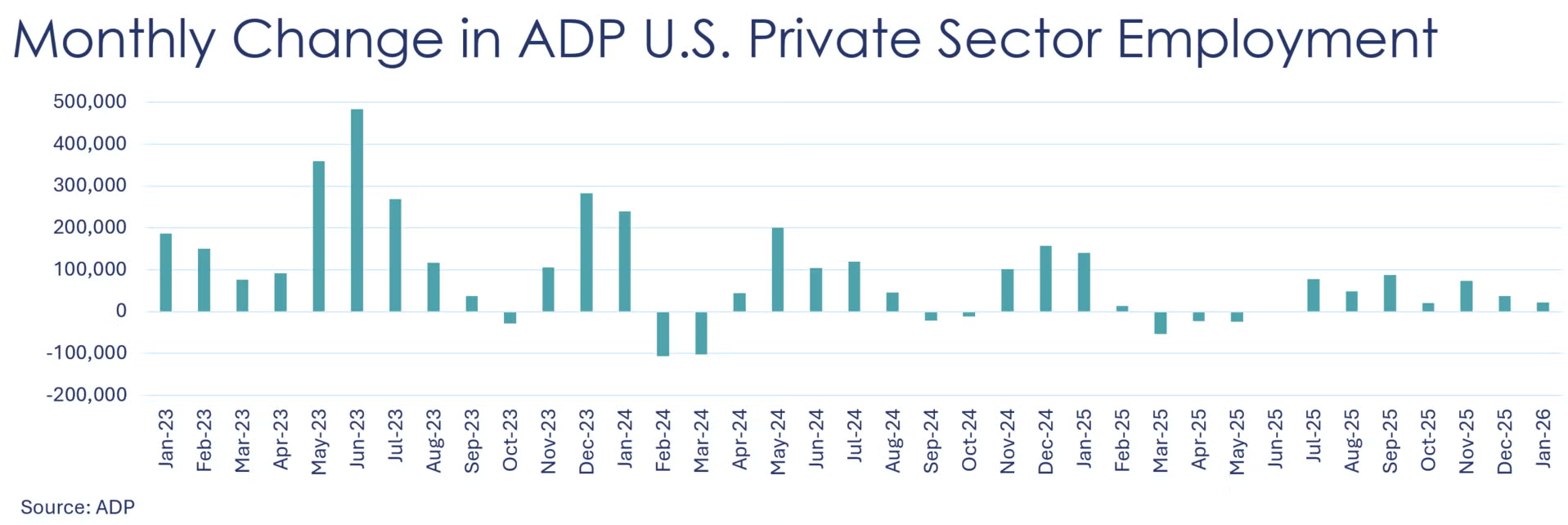

Light vehicle sales started the year on a soft note falling to a 14.9 million seasonally adjusted annual pace, the slowest pace since February 2023. The winter storm that hit at the end of January likely contributed to the decline. EV sales continued to be weak the expiration of tax credits at the end of September.

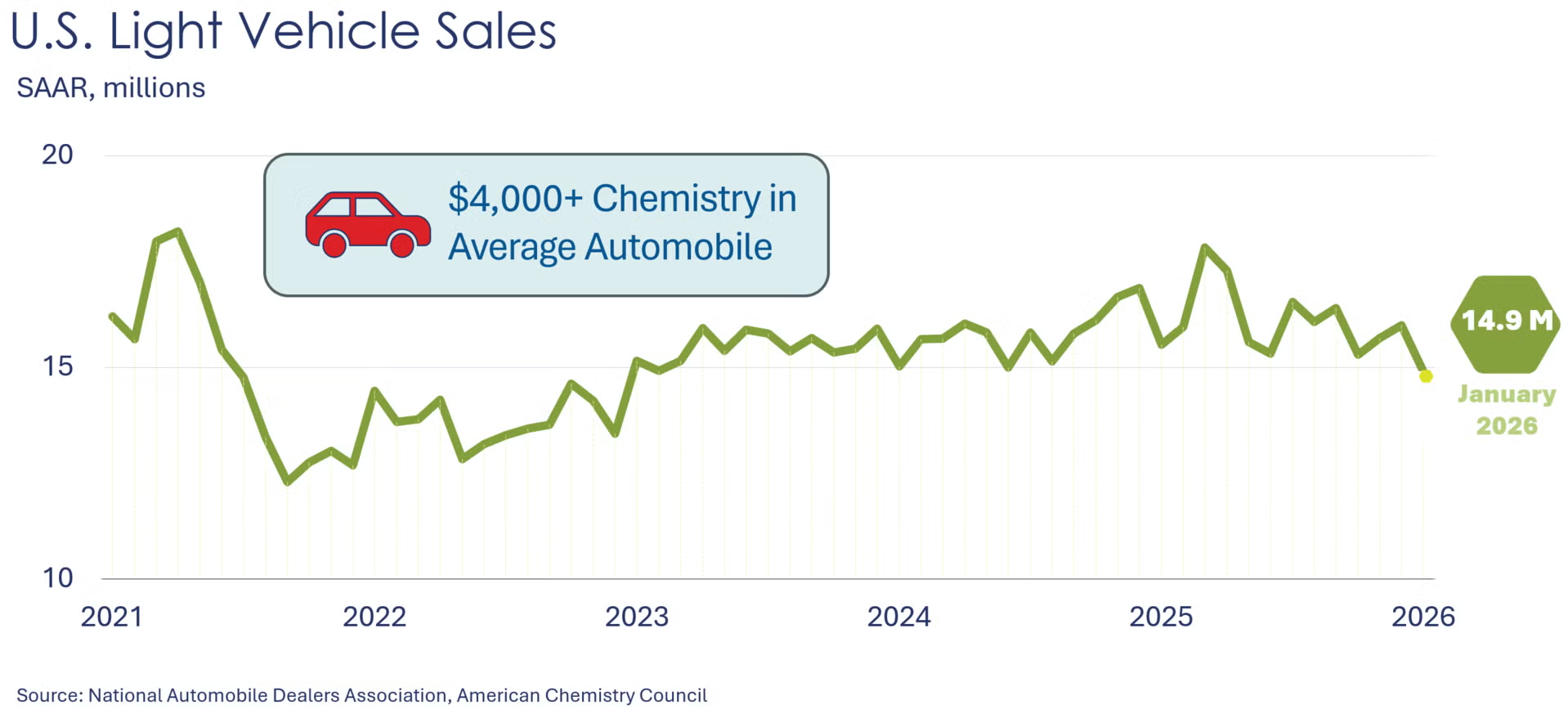

The ISM Manufacturing PMI® rose 4.7 points in January to 52.6, the first month of expansion (i.e., above 50) in 12 months. New orders, backlog of orders, and new export orders switched from contracting to growing, while production grew faster compared to the previous month. The new orders, production, and order backlogs indexes reached their highest levels since 2022. Supplier deliveries slowed further, suggesting increasing demand continued to stretch supplier capacity as inventories contracted at a slower pace. Prices increased while customers’ inventories were deemed “too low”, both at faster rates than the previous month. Employment contracted at a slower pace, with labor was cited as being in short supply. Nine industries reported expansions in January while eight reported contractions. Of the six largest industries, five expanded in January: transportation equipment, machinery, chemicals, food/beverage/tobacco, and computer & electronic products.

Looking abroad, global manufacturing continued to expand. The JP Morgan Global Manufacturing PMI® rose 0.5 points to 50.9. There were expansions across consumer, intermediate, and investment goods. Manufacturing activity expanded in the U.S., India, UK, Taiwan, Japan, South Korea, and several ASEAN nations. Manufacturing output contracted in the Eurozone, Türkiye, and Brazil.

The ISM Services PMI® remained unchanged at 53.8 in January, above the 50-point growth borderline. Increases in business activity/production and backlog of orders were offset by declines in new export orders, inventories, new orders, imports, and employment. Supplier deliveries slowed faster (which is compatible with growth) while prices advanced at a higher pace. Inventory sentiment remained “too high”.

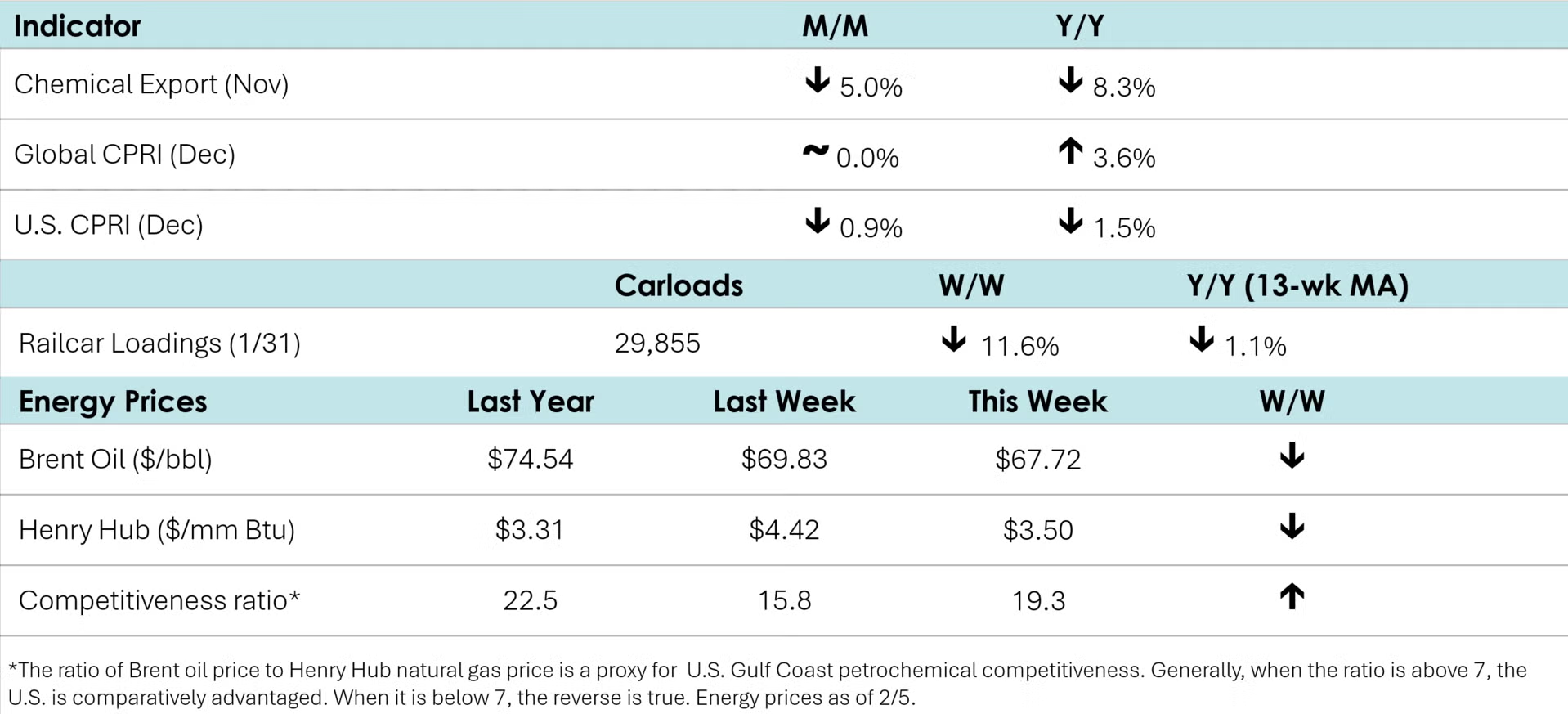

According to data released by the Association of American Railroads, chemical railcar loadings fell to 29,855 for the week ending January 31st. Loadings were down 1.1% Y/Y (13-week MA) and up 2.4% YTD.

Within the details of the ISM Manufacturing PMI® report, the chemical industry was reported to be in expansion in January. One chemical industry respondent noted, “A new year, with new challenges. We are moving manufacturing from China to Mexico — which will now impose tariffs on parts made in China. This push for more of a Mexican supply chain and creates some short-term supply management concerns.” The chemical industry reported expansions in new orders and production as customer inventories were “too low”. Supplier deliveries slowed while employment contracted and prices increased. Inventories and order backlogs were unchanged while both imports and exports declined.

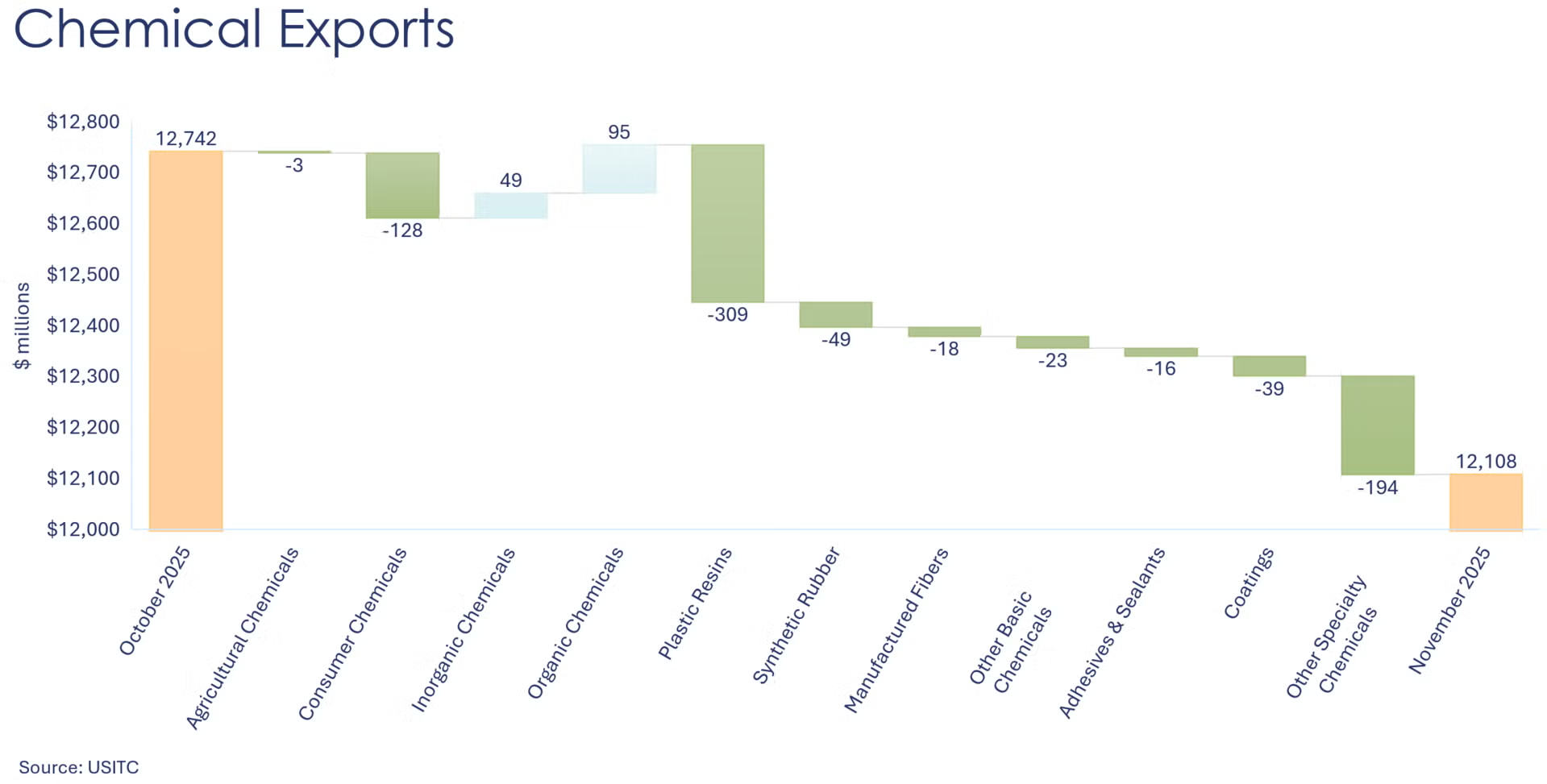

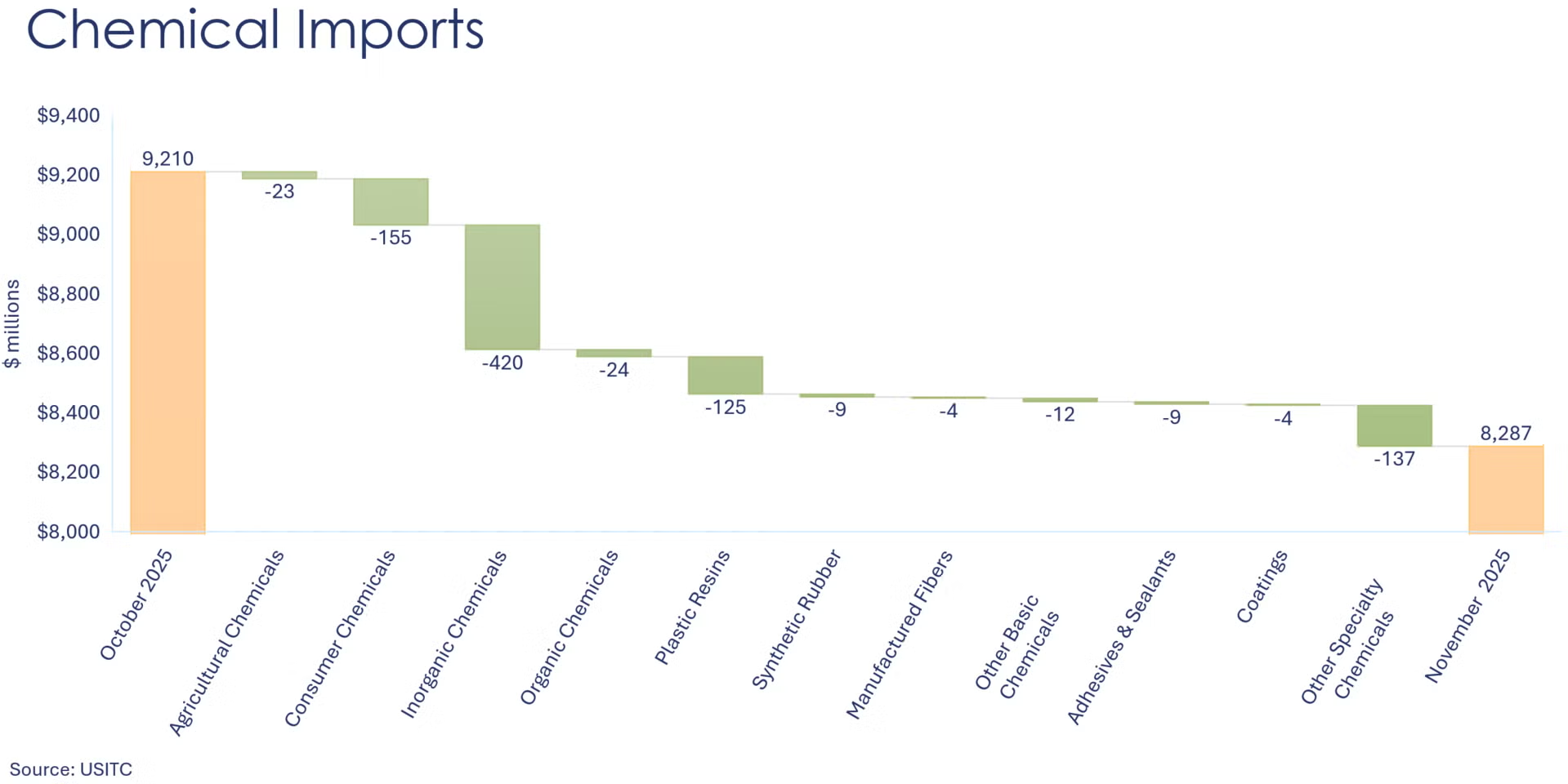

After a brief improvement in October, chemical exports fell back in November, declining 5.0%. All major segments posted decreases, with consumer products and specialties leading the pullback. Exports of inorganics and bulk petrochemicals and intermediates increased, however. Chemical imports also weakened, dropping 10.0% more than reversing October’s gains. Every major import category saw a decrease. Compared with a year ago, exports were down 8.3%, while imports plunged 23.3%. As a result, the trade surplus edged up to $3.8 billion, slightly higher than $3.5 billion in September.

On a volume basis, U.S. plastic resin exports followed a similar pattern. After showing modest improvement in October, resin exports fell 7.2% in November to 2.0 million metric tons. On a year-over-year basis, resin exports were 1.6% lower.

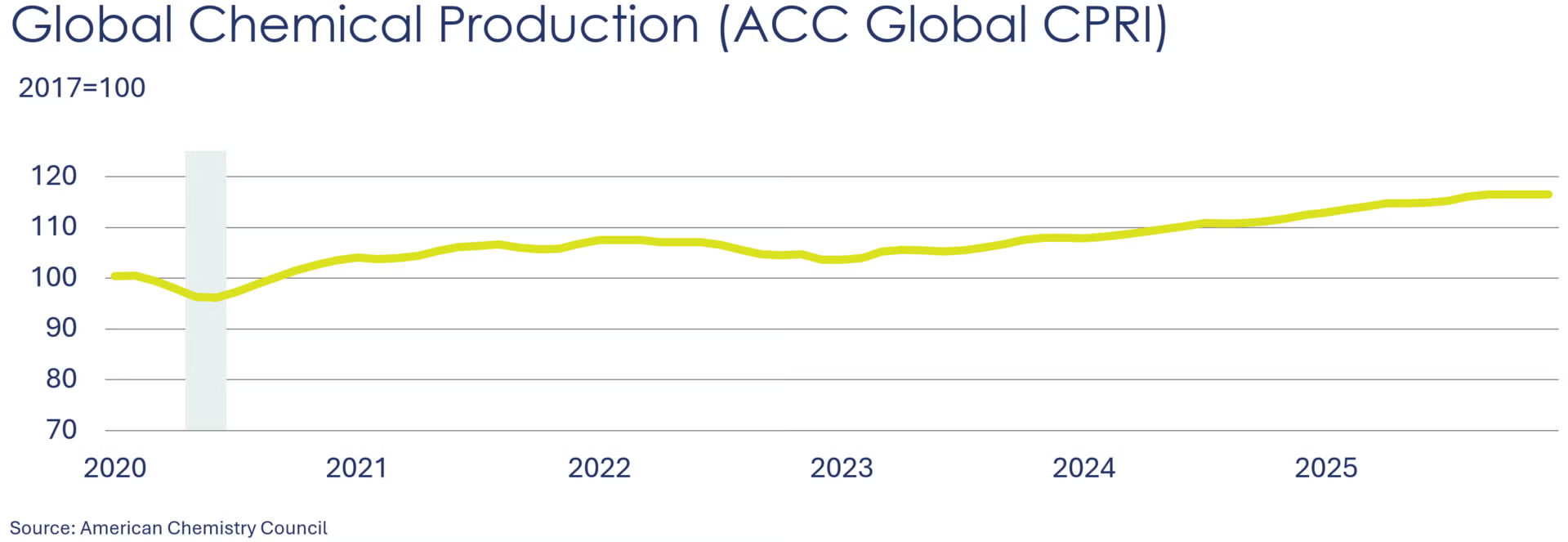

Following a stagnant November, global chemical production remained flat in December, with the ACC’s Global Chemical Production Regional Index showing 0.0% month over month change. Regional performance was mixed: the Asia Pacific region posted a modest increase of 0.3%, while both North America and Europe saw declines of 0.8%. Argentina recorded the strongest rise among all regions, with chemical production up 2.2%.

Across product segments, agricultural chemicals led with a 0.5% increase, while organics and inorganics each edged down by 0.1%. Despite the stagnant monthly reading, global chemical production in December 2025 was 3.6% higher than in the same month a year earlier.

The U.S. CPRI fell by 0.9% in December. This index measures chemical production trends based on a three-month moving average to smooth out month-to-month volatility. Production declined in all regions. Overall, the U.S. CPRI was 1.5% lower than it was a year ago.

Energy Wrap-Up

• Oil prices eased from a week ago ahead of Friday’s U.S.-Iran talks in Oman.

• U.S. natural gas prices remain elevated, but lower than last week, despite a record inventory withdrawal due to strong heating demand during last week’s polar vortex.

• Last week’s polar vortex triggered the largest-ever withdrawal of natural gas inventories. Working gas inventories were down 360BCF during the week ending January 31st. Despite the draw, gas inventories remained ahead of year-ago levels and slightly below the five-year historical average.

• The combined oil & gas rig count rose by three to 536.

For More Information

ACC members can access additional data, economic analyses, presentations, outlooks, and weekly economic updates through ACCexchange: https://accexchange.sharepoint.com/Economics/SitePages/Home.aspx

In addition to this weekly report, ACC offers numerous other economic data that cover worldwide production, trade, shipments, inventories, price indices, energy, employment, investment, R&D, EH&S, financial performance measures, macroeconomic data, plus much more. To order, visit http://store.americanchemistry.com/.

Every effort has been made in the preparation of this weekly report to provide the best available information and analysis. However, neither the American Chemistry Council, nor any of its employees, agents or other assigns makes any warranty, expressed or implied, or assumes any liability or responsibility for any use, or the results of such use, of any information or data disclosed in this material.

Contact us at ACC_EconomicsDepartment@americanchemistry.com.