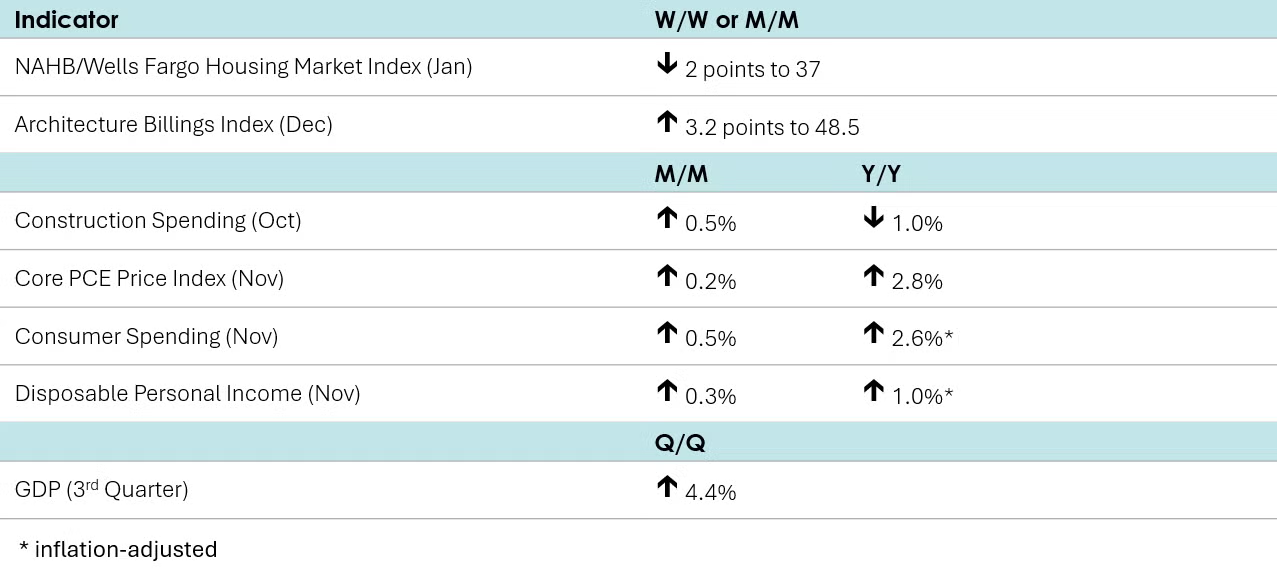

Consumer spending rose 0.5% in November, led by higher spending on health care, gasoline, motor vehicles and parts, financial services & insurance, and other services. Disposable personal income also rose, up by 0.3%, driven by higher employee compensation and personal dividend income. The savings rate was 3.5%, down from 3.7% in October. Compared to a year ago, inflation-adjusted consumer spending was up 2.6% Y/Y while income was 1.0% Y/Y higher.

The headline personal consumption expenditures (PCE) price index rose 2.8% Y/Y in November, up slightly from 2.7% Y/Y in October. Excluding food and energy, the core PCE price index also added 2.8% Y/Y, up from 2.7% in October.

A leading indicator for nonresidential construction activity, AIA’s Architectural Billings Index rose 3.2 points to 48.5 in December, the highest level since November 2024. Despite December’s improvement, the ABI remains under 50, continuing to reflect a contraction in billings. Upstream inquiries into new projects moved up while the value of new design contracts continued to soften, although at a lower rate than the previous month.

Homebuilder confidence declined slightly in January as the NAHB/Wells Fargo Housing Market Index dropped two points to 37. Current sales activity, sales expectations for the next six months, and buyer traffic posted declines. The survey revealed that 40% of builders cut prices, same as in December, with the average price reduction coming in at 6% and the use of sales incentives reaching 65%, the tenth consecutive reading above 60%.

Construction spending partially rebounded in October, up by 0.5%. A 1.3% gain in spending on privately funded residential projects offset a decline in the nonresidential sector. Publicly-funded construction was marginally higher. Compared to a year ago, construction spending was off 1.0% Y/Y.

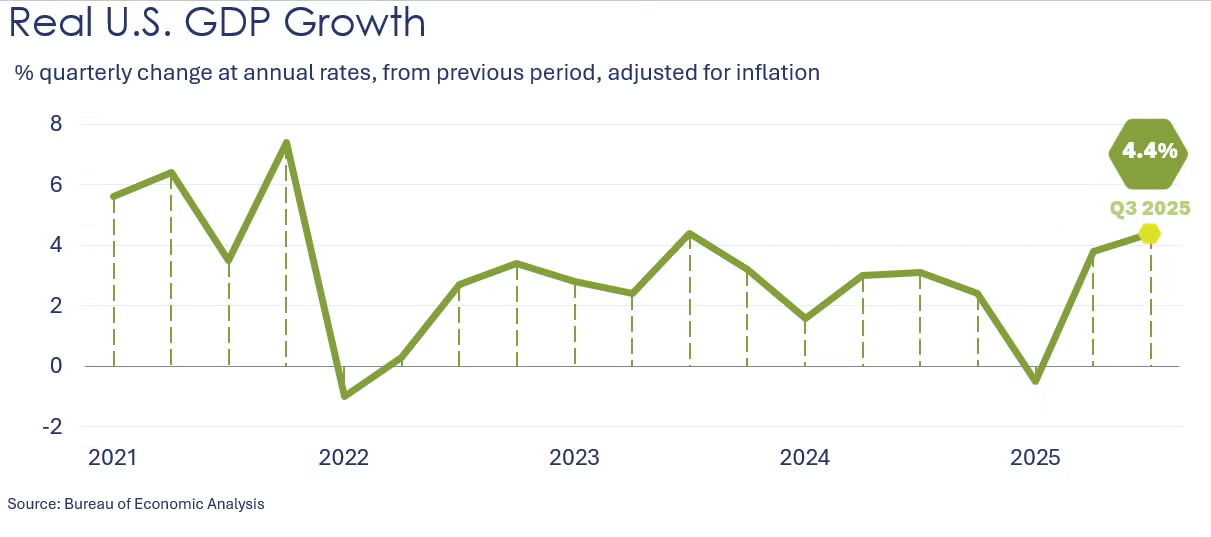

In an expected update, BEA now estimates that Q3 GDP rose at a 4.4% seasonally adjusted annual rate (SAAR), a slight increase from last month’s preliminary estimate. The revisions primarily reflect upward revisions to exports and investment that were partly offset by a downward revision to consumer spending and higher imports (which counts as an offset to GDP).

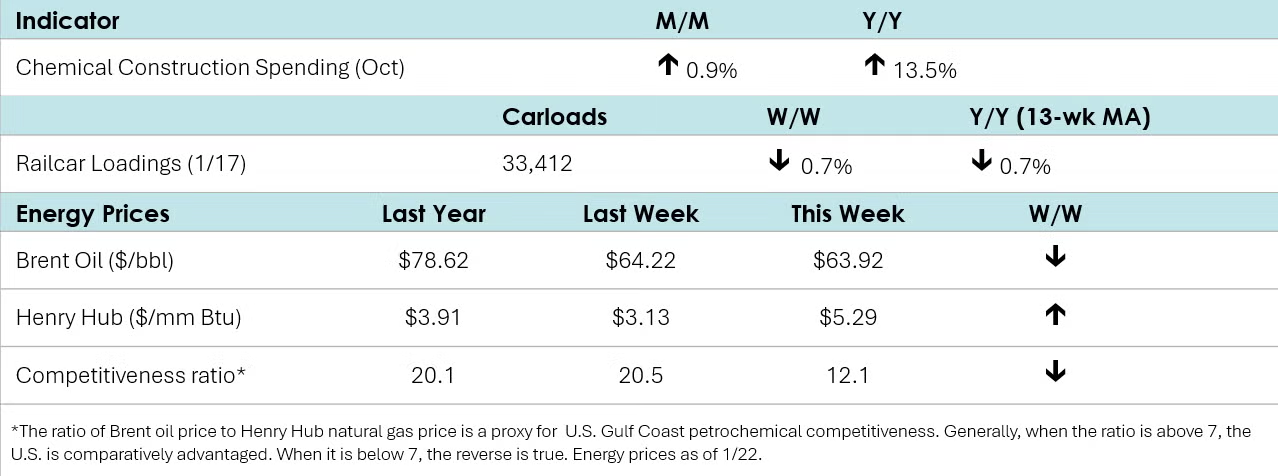

According to data released by the Association of American Railroads, chemical railcar loadings were down slightly to 33,412 during the week ending January 17th. Loadings were down 0.7% Y/Y (13-week MA) and up 2.4% YTD.

Chemical construction spending advanced in October, up 0.9% to $46.5 billion. Compared to a year ago, chemical construction spending was up 13.5% Y/Y. Chemical manufacturing construction represented 33% of all manufacturing construction spending in October.

Energy Wrap-Up

• Oil prices eased compared to a week ago as trade tensions related to Greenland subsided.

• U.S. natural gas prices surged this week in anticipation of a polar vortex expected to plunge much of the country into subfreezing temperatures. U.S. natural gas inventories continued to be ahead of year ago levels and the five-year historical average.

• The combined oil & gas rig count fell by one to 532.

For More Information

ACC members can access additional data, economic analyses, presentations, outlooks, and weekly economic updates through ACCexchange: https://accexchange.sharepoint.com/Economics/SitePages/Home.aspx

In addition to this weekly report, ACC offers numerous other economic data that cover worldwide production, trade, shipments, inventories, price indices, energy, employment, investment, R&D, EH&S, financial performance measures, macroeconomic data, plus much more. To order, visit http://store.americanchemistry.com/.

Every effort has been made in the preparation of this weekly report to provide the best available information and analysis. However, neither the American Chemistry Council, nor any of its employees, agents or other assigns makes any warranty, expressed or implied, or assumes any liability or responsibility for any use, or the results of such use, of any information or data disclosed in this material.

Contact us at ACC_EconomicsDepartment@americanchemistry.com.