For the second quarter in a row, U.S. chemical manufacturers reported deterioration in their company’s activity level overall (e.g., sales, production, output) and weakening demand across major customer markets. The latest findings from ACC’s latest Chemical Manufacturing Economic Sentiment Index (ESI) also point to an increasingly pessimistic short-term outlook on the economy and the regulatory environment.

As uncertainty around the economic climate continues, ACC’s ESI findings are shedding light on the situation and outlook. The ESI provides important insight from chemical companies engaged in nearly every aspect of the manufacturing sector and the U.S. economy.

Key Findings

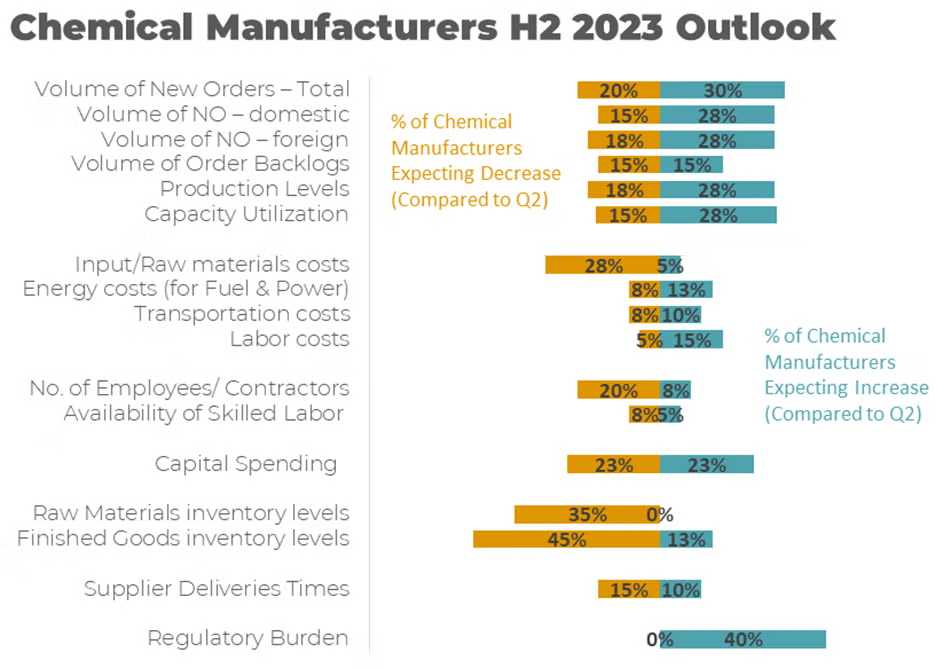

Second quarter (Q2) ESI readings indicate chemical manufacturers’ new orders growth was nearly flat, production levels decreased and inventories of both raw materials and finished goods were worked down. Producer costs related to inputs/raw materials, energy (for fuel and power), and transportation continued to retreat in Q2 while labor costs accelerated.

Regulatory Headwinds

A new finding for this survey found the level of regulatory burden on domestic chemical manufacturing has risen significantly. The Q2 ESI reading indicates that regulatory pressure remains elevated for many companies and continues to increase for others. ACC’s ESI reading on the change in the level of regulatory burden (i.e., compliance and opportunity costs) over Q2 (compared to Q1 this year) was notably high at 37.5. A strong (+40.0) reading for the coming six months indicates chemical manufacturers are anticipating growing regulatory challenges.

"Chemical manufacturers have been navigating an escalating level of regulatory burden on U.S.-based operations, which threatens to erode competitiveness and hold back growth,” said ACC Director for Economics and Data Analytics Emily Sanchez.

“The most recent ESI reading of rising compliance and opportunities costs related to regulations is concerning” Sanchez added. “Chemical companies are challenged in an increasingly unfavorable business environment.”

Methodology

The ESI is a quarterly index created to help better understand the state of the chemical industry. The index captures the collective perspective of ACC member companies regarding their business activities, customer market demand and the economic situation in the current quarter, and their expectations for the next six months.

The ESI is a composite index comprised of several sub-components that track changes in chemical manufacturers’ perspectives on key business variables including:

- Business activity (new orders, production levels)

- Costs (inputs, energy, transportation, labor)

- Labor (levels, availability)

- Capital (spending)

- Inventories

- Supplier Deliveries Times

Regulatory Burden - Business activity (new orders, production levels)

You can view the complete findings here.