Economic Factors

Moving into the end of Q2, the U.S. economy looks either resilient or weak, depending on where you’re standing. The services sector of the economy is continuing to expand, but manufacturing has been struggling.

The strong pandemic-driven rebound in goods spending has subsided as consumers have turned their attention (and wallets) to travel, eating out, and other services. Fueled by excess savings that accumulated during the pandemic, consumers have been able to continue spending and bear higher prices, driving inflation.

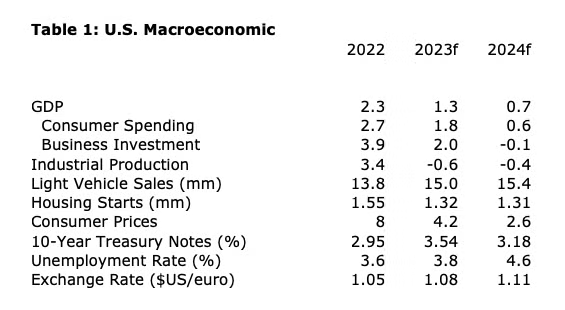

Consumer spending has slowed, however, as the cushion of excess savings is exhausted. While wage gains are catching up to the rate of inflation, real wages continue to decline, limiting households’ purchasing power. We look for growth in real consumer spending to slow to 1.8% in 2023 and ease to a 0.6% gain in 2024.

While the pace inflation has improved from the peak reached in mid-2022, it remains stubbornly high despite aggressive Fed action to raise interest rates. We expect inflation to average 4.2% in 2023 (following 8.0% in 2022) before slowing to 2.6% in 2024. Recent banking turmoil and tightening lending standards are also curbing economic activity.

The labor market has remained surprisingly resilient, though job growth and other measures of labor demand have slowed since the beginning of the year.

Growth in business investment has also slowed due to higher borrowing costs and substantial economic uncertainty. Investment is expected to slow to 2.0% in 2023 and ease slightly by 0.1% in 2024.

Going into the second half of the year, there is tremendous uncertainty, and the risk of recession remains high. We expect U.S. GDP to slow to a 1.3% gain in 2023 and slow further to 0.7% in 2024.

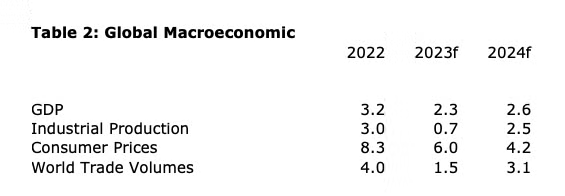

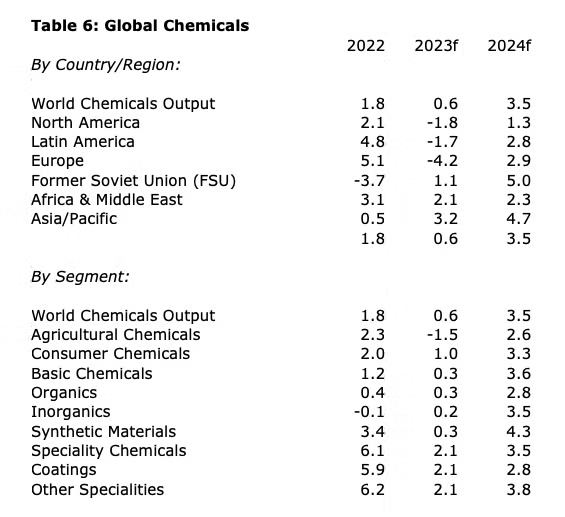

Looking abroad, China’s post-zero-Covid recovery has been slow and Europe continues to struggle with disruptions from Russia’s invasion of Ukraine. Economic expansion in emerging Asia/Pacific (especially India) will offset weaker GDP growth in Europe, Japan and North and South America. We expect global economic growth to ease to a 2.3% pace in 2023 before picking up modestly to a 2.6% pace in 2024. With weaker growth and a global shift away from spending on goods, global industrial production growth will slow to 0.7% and trade volumes growth will ease to a 1.5% pace in 2023. In 2024, we expect global production and trade volumes to grow by 2.5% and 3.1%, respectively.

End Use Markets

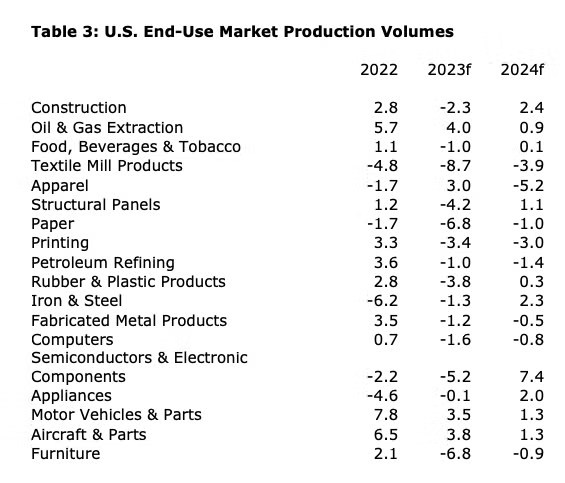

More than 85% of basic and specialty chemicals are consumed by the industrial sector and the outlook for industrial production remains weak. We expect overall industrial production to fall 0.6% this year with only four of the 18 key end-use markets we track to expand in 2023. In 2024, production continues to ease by 0.4% before rebounding in 2025.

With more than $4,000 of chemistry products in every vehicle, motor vehicles are an important end-use market for chemistry. Following three years of well below average sales initially due to the pandemic and then semiconductor shortages, assemblies are up and dealer inventories have been replenished. Pent up demand for vehicles will be tempered, however by higher borrowing costs and uncertainty. As a result, we expect vehicle sales to rise to 15.0 million this year and rise to 15.4 million in 2024.

Housing is another important consumer of chemistry products. Following a surge of activity driven by remote work during the pandemic, the housing market was among the first casualties of higher interest rates. Housing starts fell in 2022 for the first time since the housing crisis in 2009. With many existing home mortgages financed with low rates over the past decade, owners of existing homes face disincentives to move to new properties at higher mortgage rates. As a result, inventories of existing homes are historically lean which may provide some support for new homebuilding. We expect housing starts to fall to 1.32 million in 2023 and easing to 1.31 in 2024.

Chemical Production

Weakness in U.S. chemicals emerged in Q3 ‘22 and accelerated into the end of last year offsetting strong growth earlier in the year. Inventory destocking and production outages due to weather-related disruptions and refinery maintenance negatively impacted output in Q1. Going into the second half of the year, inventory destocking has largely been resolved, but signs of customer restocking have yet to materialize. Firms throughout the supply chain are cautiously managing their inventories given the uncertain economic environment. This is consistent with the findings of ACC’s new Economic Sentiment Index that found that chemical firms felt that overall business activity and major customer demand deteriorated in Q1, but were expected to improve over the next six months.

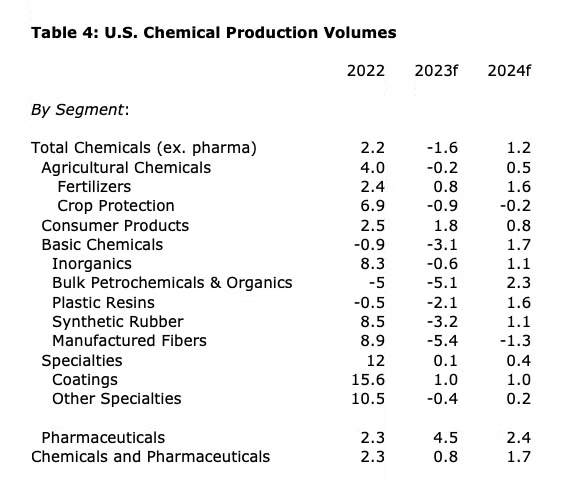

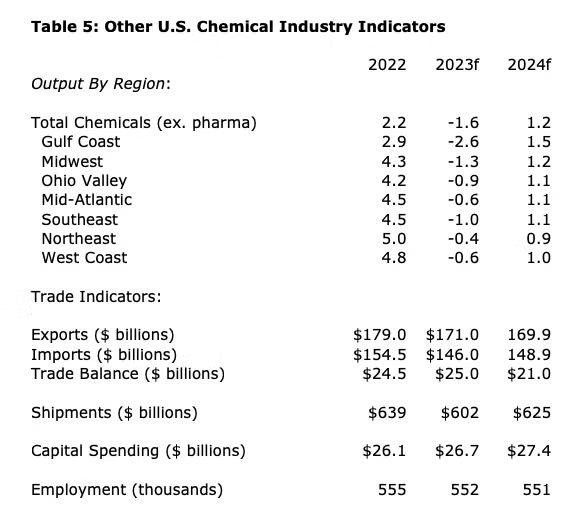

Because of the chemical industry’s early position in the supply chain, we would expect to see a turnaround in chemicals before improvement in the broader economy. We expect chemical output volumes to fall 1.6% in 2023 with lower output in most segments. In 2024, we expect a modest recovery in all segments with overall chemistry output growing by 1.2%.

Output of basic chemicals in the U.S. is expected to fall 3.1% in 2023 with the largest decline in petrochemicals and organic intermediates. Production of synthetic materials is also expected to fall. Specialty chemical output will be essentially flat in 2023 as a gain in coatings is offset by declines in other specialty chemical categories. Overall output of agricultural chemicals will decline slightly with falling output of crop protection chemicals only partially offset by a gain in fertilizer production, led by higher exports of nitrogenous fertilizers. Production of consumer products is expected to grow by 1.8%. We expect output from the chemical industry to increase around 2.0% per year between 2024 and 2031 in the United States compared to 2.6% globally.

The longer-term outlook for U.S. chemistry is positive with the natural gas liquids feedstock advantage continuing to favor U.S. production for the foreseeable future. In addition, capacity expansions in customer industries motivated by recent legislation (IRA, IIJA, CHIPS) and re-/near-shoring of manufacturing to North America will support U.S. chemistry going forward.

Following two years of double-digit growth, external demand for manufactured goods and chemical inputs has softened. Weakness in the economic environment and the industrial sector, especially, will result in a 4.5% decline in U.S. chemical exports in 2023 and a 0.6% decline in 2024. U.S. chemical imports will also decline this year, by 5.5%, before picking up to 2.0% growth in 2024. The U.S. will maintain a trade surplus in chemicals throughout the forecast horizon.

Capital spending slows to a 2.4% gain in 2023, but then continues to expand through 2026 (averaging ~3-4%). Increasingly, sustainability investments take a larger share of the capex portfolio.

Chemical industry employment surged in 2022 with the industry gaining more than 18,000. In 2023, employment is expected to fall by 3,000 and by another 1,000 in 2024.

Globally, chemical production is expected to expand by 0.6% in 2023 with gains in Asia/Pacific, Africa & Middle East, and former Soviet Union countries offsetting production declines in Europe, North America and Latin America. Stronger growth of 3.5% is expected in 2024 as global industrial production picks up.

Of course, there are several risks to the outlook and policy mistakes by the Fed and other central banks are top among them. In addition, financial volatility, external shocks (i.e., weather, cyberattack, etc.), and geopolitical risk could also disrupt the outlook.

The regulatory environment in the United States is a top concern as current and proposed policies negatively impact critical chemistries that make up the supply chain.

Moving beyond the short-term downturn, prospects for U.S. chemistry remain strong with competitive energy fundamentals and the resurgence in U.S. manufacturing from once-in-a-generation legislative initiatives to promote clean energy, infrastructure, and a strong domestic manufacturing base.

The full data set with historic trends and forecasts through 2026 is available to ACC members on ACCExchange and to others on the ACC Store.

Reasonable effort has been made in the preparation of this publication to provide the best available information. However, neither the American Chemistry Council, nor any of its employees, agents or other assigns makes any warranty, expressed or implied, or assumes any liability or responsibility for any use, or the results of such use, of any information or data disclosed in this material.