Note: Durable Goods Orders, Gross Domestic Product, Personal Income, Consumer Spending, and the Personal Consumption Expenditures Price Index were scheduled for release this week but are unavailable due to the federal government shutdown. Where available, we will include alternative private-sector data in order to continue monitoring the U.S. economy.

Texas manufacturing conditions remained negative in October, with the general business conditions index of Dallas Fed’s Texas Manufacturing Survey up 3.7 points to -5.0. Production expanded at a stable pace, but new orders, unfilled orders and capacity utilization eased. Finished goods inventories continued to contract in October. And capital spending expanded at a slower pace. The index for outlook uncertainty rose during the month. Firms remained optimistic that business conditions would improve over the next six months, however.

The Chicago PMI climbed to 43.8 from 40.6 in September. While October’s was the 23rd consecutive reading below 50 (corresponding to a contraction in manufacturing output), it was the highest level in three months. The index was propelled by a recovery in new orders, output and order backlogs. Meanwhile, the employment index dropped to its lowest level since February.

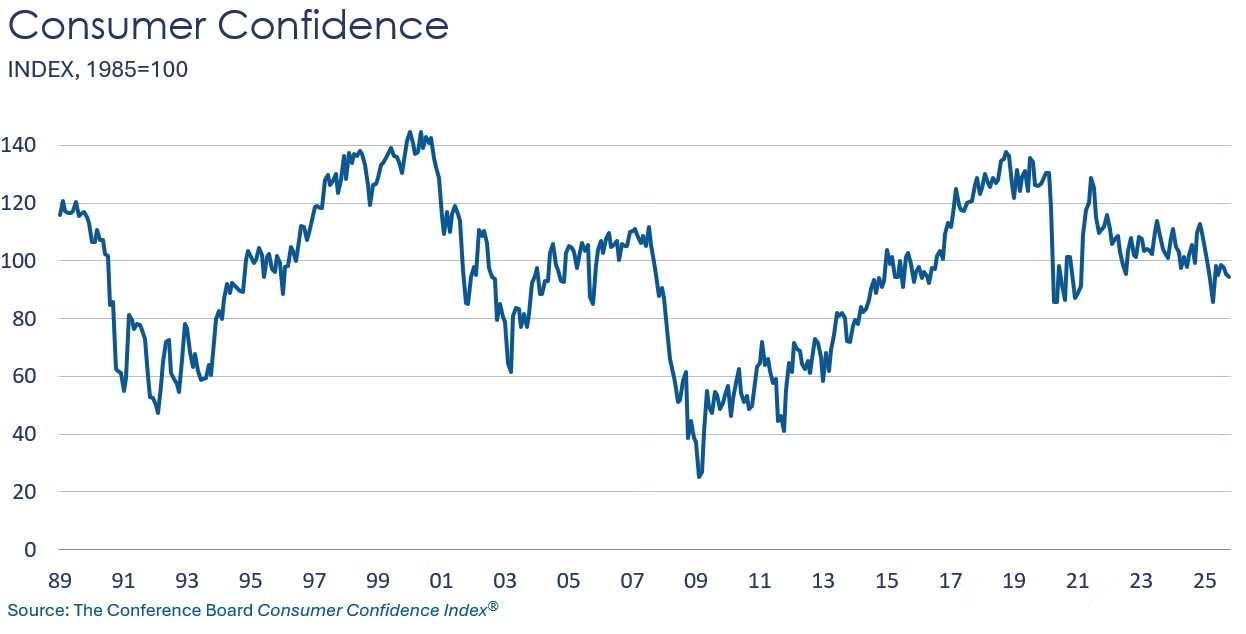

Consumer confidence was virtually unchanged in October, with the index down 1.0 point to 94.6. Expectations worsened somewhat for all three components: business conditions, employment prospects, and future income. Since February, expectation levels have corresponded with a recession lying ahead, the Conference Board reported. However, purchasing plans for cars increased, especially for used cars. At the same time, plans for buying homes weakened in October although they remain relatively strong. Plans for purchasing big-ticket items remained mostly unchanged but have strengthened after weakening earlier in the year.

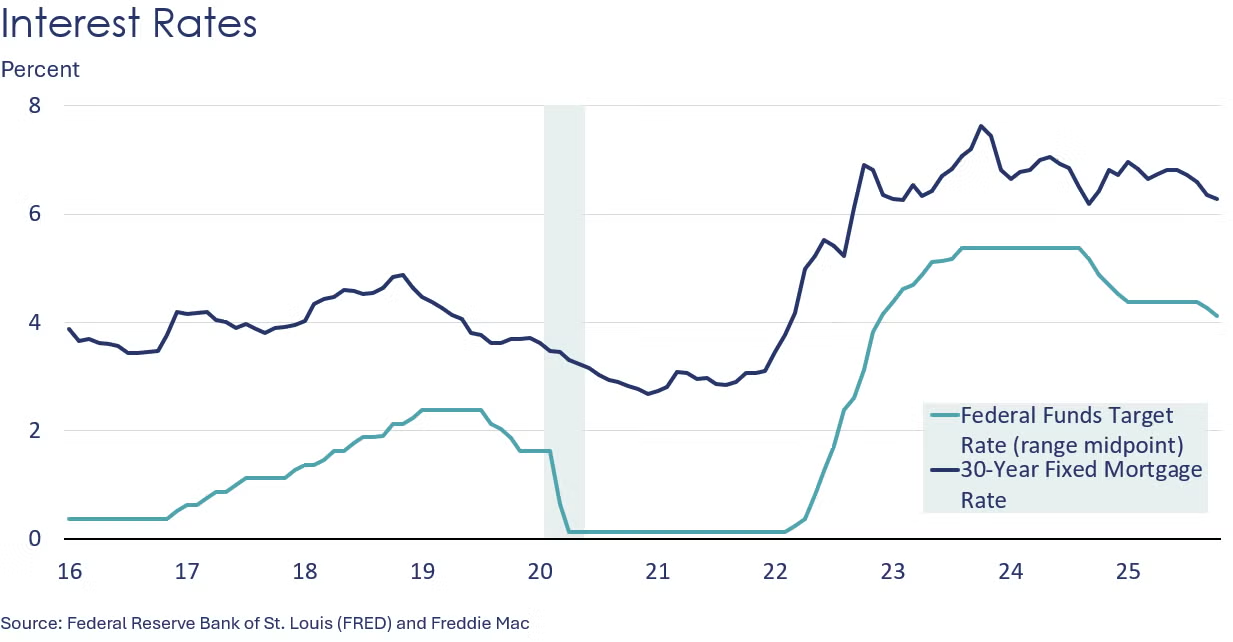

Despite limited access to new data due to the Federal government shutdown, the Federal Reserve lowered interest rates by another 25 basis points this week. The move follows a similar rate cut in September. The Fed cited rising downside risks to employment in recent months, though it also noted that “inflation has moved higher since the beginning of the year and remains somewhat elevated”. It generally takes several months for changes in the Federal Funds rate to work its way through the economy.

Due to the federal government shutdown, the release of the U.S. and Global Chemical Production Regional Index (CPRI), published by ACC, has been delayed. These indices rely on data from various U.S. government agencies, which are currently unavailable. Publication will resume once the necessary data is accessible. In the interim, we will continue to provide snapshots of chemical production activity in other parts of the world, where data is available.

China saw strong chemical output in August (up 1.3%), but production growth slowed in September (up 0.6%), in part due to Super Typhoon Ragasa which made landfall in southern China, prompting temporary plant closures in that part of the country. Despite this disruption, export demand for chemical products and electric vehicles remained strong, which is expected to support chemical production in the coming months. On a year-on-year basis, production rose 10.4% compared to the same period last year.

In Europe, chemical output continued to decline by 0.7%, mainly due to elevated energy costs and ongoing trade-related uncertainties. However, Spain and Italy seemed to perform better than the rest of Europe. On a year-on-year basis, production declined 3.1% compared to the same period last year.

South American output varied. In Brazil, trade-related uncertainties weighed on production, while private investment in Chile fell, which may have dampened industrial demand there. Argentina’s output rebounded despite a currency crisis. On a year-on-year basis, production declined 0.5% compared to the same period last year.

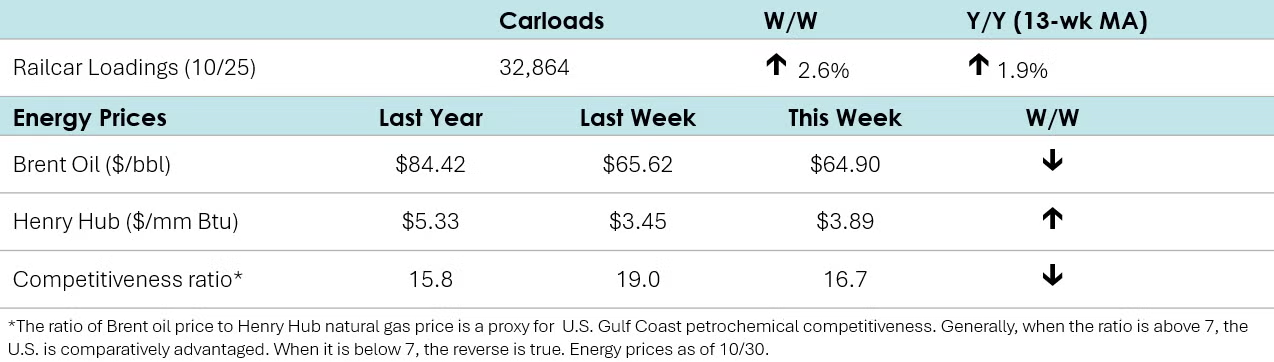

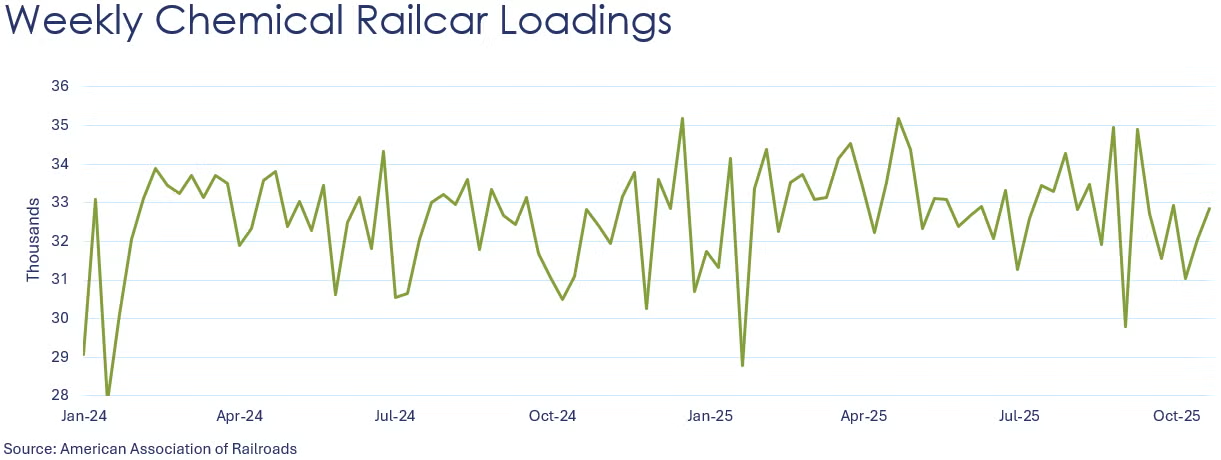

According to data released by the Association of American Railroads, chemical railcar loadings were up to 32,864 for the week ending October 25. Loadings were up 1.9% Y/Y (13-week MA), up 1.6% YTD/YTD and have been on the rise for seven of the last 13 weeks.

Energy Wrap-Up

• Oil prices held steady Thursday as investors assessed a potential trade truce between the U.S. and China after President Trump lowered tariffs (by 10%) on China following a meeting with Chinese leader Xi Jinping.

• EIA’s Weekly Natural Gas Storage Report showed a higher-than-forecasted 74 Bcf build, reflecting weaker consumption and milder weather conditions.

• The combined oil & gas rig count rose by two to 541 during the most recent week.

For More Information

ACC members can access additional data, economic analyses, presentations, outlooks, and weekly economic updates through ACCexchange: https://accexchange.sharepoint.com/Economics/SitePages/Home.aspx

In addition to this weekly report, ACC offers numerous other economic data that cover worldwide production, trade, shipments, inventories, price indices, energy, employment, investment, R&D, EH&S, financial performance measures, macroeconomic data, plus much more. To order, visit http://store.americanchemistry.com/.

Every effort has been made in the preparation of this weekly report to provide the best available information and analysis. However, neither the American Chemistry Council, nor any of its employees, agents or other assigns makes any warranty, expressed or implied, or assumes any liability or responsibility for any use, or the results of such use, of any information or data disclosed in this material.

Contact us at ACC_EconomicsDepartment@americanchemistry.com.